The Export Promotion Capital Goods (EPCG) Scheme is a government initiative that aims to facilitate the import of capital goods at concessional customs duty rates for the purpose of manufacturing and export.

The EPCG scheme was introduced in India in the early 1990s and has since been revised several times to keep up with changing market conditions.

The EPCG scheme is one of several export promotion schemes offered by the Indian government to encourage exports and boost the country’s economy.

The scheme is open to all Indian exporters, including small and medium-sized enterprises, and provides them with a number of benefits, including duty-free import of capital goods, exemption from payment of GST on capital goods procured domestically, and other concessions.

The EPCG scheme has been successful in promoting exports in India across various sectors.

Key Takeaways

- The EPCG Scheme is a government initiative that aims to facilitate the import of capital goods at concessional customs duty rates for the purpose of manufacturing and export.

- The scheme is open to all Indian exporters and provides them with several benefits, including duty-free import of capital goods and other concessions.

Overview of Export Promotion Capital Goods Scheme

EPCG Scheme Purpose

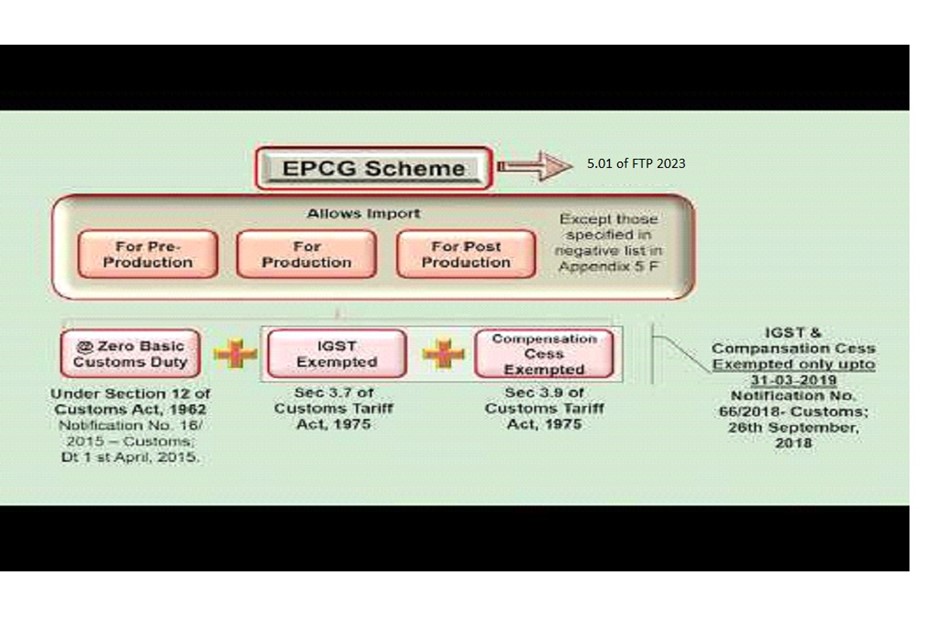

The Export Promotion Capital Goods (EPCG) Scheme is an export incentive scheme introduced by the Government of India to promote the export of capital goods. The scheme allows manufacturers to import capital goods at zero or concessional customs duty rates to enhance their competitiveness in the global market.

The primary objective of the EPCG scheme is to facilitate the import of capital goods to produce goods and services that are meant for export. The scheme aims to boost the manufacturing sector and increase the export of Indian goods and services.

EPCG Scheme Eligibility

The EPCG scheme is available to all Indian manufacturers who have a valid license to import capital goods. The license can be obtained from the Directorate General of Foreign Trade (DGFT) by submitting an application along with the necessary documents.

To be eligible for the EPCG scheme, the manufacturer must meet the following criteria:

- The manufacturer must be registered with the relevant authorities and must have a valid Import-Export Code (IEC) issued by the DGFT.

- The manufacturer is also required to fulfil export obligation equivalent to six times the duty saved on the import of capital goods. The export obligation must be fulfilled within a period of six years from the date of issuance of the license.

- The capital goods imported under the EPCG scheme must be used for manufacturing goods and services that are meant for export. The goods and services must be notified in the license issued by the DGFT.

In conclusion, the EPCG scheme is an important export incentive scheme that promotes the export of capital goods from India.

Key Features of EPCG Scheme

Import of Capital Goods

The Export Promotion Capital Goods (EPCG) Scheme is a program initiated by the Government of India to encourage exports by allowing the import of capital goods at zero or concessional customs duty rates.

Under this scheme, an exporter can import capital goods required for production or manufacturing of export goods without paying any customs duty.

This scheme is beneficial for exporters as it reduces the cost of production and enhances the competitiveness of Indian goods in the global market.

To be eligible for the EPCG scheme, an exporter must have a minimum export obligation of six times the duty saved amount on capital goods imported under the scheme.

The export obligation must be fulfilled within six years from the date of issuance of the EPCG license. The scheme is available for both the manufacturer exporter and merchant exporter.

The exporter is also required to fulfil average obligation which is average of last three years export.

Export Obligation

The EPCG scheme requires the exporter to fulfill an export obligation, which is the minimum amount of export that the exporter must achieve within a specified time frame.

The export obligation is calculated as a multiple of the duty saved amount on capital goods imported under the scheme.

The exporter must achieve the export obligation within six years from the date of issuance of the EPCG license. In addition, the exporter is also required to fulfil average obligation which is average of last three years export.

In case the exporter fails to fulfill the export obligation, the duty-saved amount on capital goods imported under the scheme becomes payable with interest.

The exporter can also seek an extension of the export obligation period for a maximum of two years, subject to payment of a composition fees.

Benefits of EPCG Scheme

As an exporter, participating in the Export Promotion Capital Goods (EPCG) Scheme can offer several benefits. Some of the benefits of the EPCG Scheme are:

Duty Free Imports

Under the EPCG Scheme, exporters are allowed to import capital goods duty-free, which can help reduce their costs significantly. This benefit is especially useful for small and medium-sized enterprises (SMEs) that may not have the financial resources to pay import duties.

Enhanced Export Capability

The EPCG Scheme is designed to help exporters enhance their export capability. By allowing duty-free imports of capital goods, the scheme enables exporters to upgrade their technology and machinery, which can help improve their product quality and competitiveness in the global market. This can also help increase the value of exports, which can lead to higher profits for the exporter.

These benefits can help reduce costs, improve product quality, and increase competitiveness in the global market, which can ultimately lead to higher profits for the exporter.

Procedure for EPCG Scheme

Application Process

To apply for the EPCG scheme, I need to submit an application to the Director-General of Foreign Trade (DGFT) in the prescribed format. The application should contain the following details:

- Details of the applicant like name, address, and PAN number.

- Details of the goods to be imported like description, quantity, and value.

- Details of the capital goods to be exported like description, quantity, and value.

- Details of the export obligation like quantity, value, and period of fulfillment.

The application should be accompanied by the following documents:

- A copy of the Importer-Exporter Code (IEC) issued by the DGFT.

- A copy of the Registration cum Membership Certificate (RCMC) issued by the Export Promotion Council (EPC) or Commodity Board.

- A copy of the purchase order or contract or proforma invoice or letter of credit or advance payment made by the foreign buyer.

- A copy of the invoice or packing list or shipping bill or bill of lading or airway bill or courier receipt or certificate of origin or insurance policy or any other document required by the Customs or the Reserve Bank of India (RBI).

Once the application is submitted, the DGFT will scrutinize it and issue an authorization in the form of a license. The license will contain the following details:

- Details of the applicant like name, address, and license number.

- Details of the goods to be imported like description, quantity, and value.

- Details of the capital goods to be exported like description, quantity, and value.

- Details of the export obligation like quantity, value, and period of fulfillment.

- Details of the customs duty exemption like rate, amount, and period of exemption.

Fulfillment of Export Obligation

After the authorization is issued, you need to import the capital goods within the specified period and fulfill the export obligation within the specified period. The export obligation can be fulfilled by exporting goods of the same or higher value as the capital goods imported under the scheme.

The goods can be exported through any mode like air, sea, or land.

The export proceeds should be realized in freely convertible currency and accepted to India through a designated bank within the specified period.

If you fail to fulfill the export obligation, you will be liable to pay the customs duty on the imported capital goods along with interest.

If you fulfill the export obligation but fail to realize the export proceeds, you will be liable to pay the penalty as per the Foreign Trade Policy.

Challenges and Limitations of EPCG Scheme

Compliance Issues

As with any government scheme, compliance with the rules and regulations of the EPCG scheme is a challenge that many exporters face. The scheme has strict guidelines that must be followed to receive the benefits.

Exporters must ensure that they are meeting all of the criteria laid out in the scheme, including the requirement to export goods within a certain time frame and to use the imported capital goods for the intended purpose. Failure to comply with the regulations can result in penalties and loss of benefits.

Risk of Misuse

Another challenge of the EPCG scheme is the risk of misuse.

There have been instances where exporters have used the scheme to import capital goods for their own use, rather than for the purpose of export.

This misuse of the EPCG scheme not only goes against the intended purpose of the scheme, but also results in loss of revenue for the government. To prevent such misuse, the government has implemented strict regulations and penalties for non-compliance.

In addition to these challenges, there are also limitations to the EPCG scheme. For example, the scheme is only available to certain sectors and industries, and there are limits on the value of the capital goods that can be imported.

Despite these challenges and limitations, the EPCG scheme remains an important tool for promoting exports and supporting the growth of the Indian economy.

Frequently Asked Questions

What is the Zero duty EPCG scheme?

The Zero Duty EPCG (Export Promotion Capital Goods) Scheme is an export promotion scheme that allows exporters to import capital goods without paying any customs duty. This scheme is aimed at enabling exporters to upgrade their technology and machinery to enhance their competitiveness in the global market.

What are the benefits of the EPCG scheme?

The EPCG scheme provides several benefits to exporters, including the ability to import capital goods at zero customs duty, the ability to import spares and consumables for pre-production and post-production at zero customs duty, and the ability to import capital goods at concessional customs duty for certain sectors.

What is the full form of EPCG?

The full form of EPCG is Export Promotion Capital Goods.

How does the EPCG scheme enable GST refund?

Under the EPCG scheme, exporters are allowed to import capital goods at zero customs duty. This means that they do not have to pay any GST on the import of these goods.

What is the EPCG scheme for domestic purchase?

The EPCG scheme for domestic purchase is a scheme that allows exporters to purchase capital goods from the domestic market without GST.

This scheme is aimed at promoting the use of domestically produced capital goods and enhancing the competitiveness of domestic manufacturers.

However, this scheme is subject to certain conditions and restrictions, and exporters should carefully review the eligibility criteria before applying for this scheme.